TL;DR (read this part):

- On December 9, 2025, Nova switched on Demand Sampling for Helium Mobile hotspots (Helium Status and the Helium announcement on X).

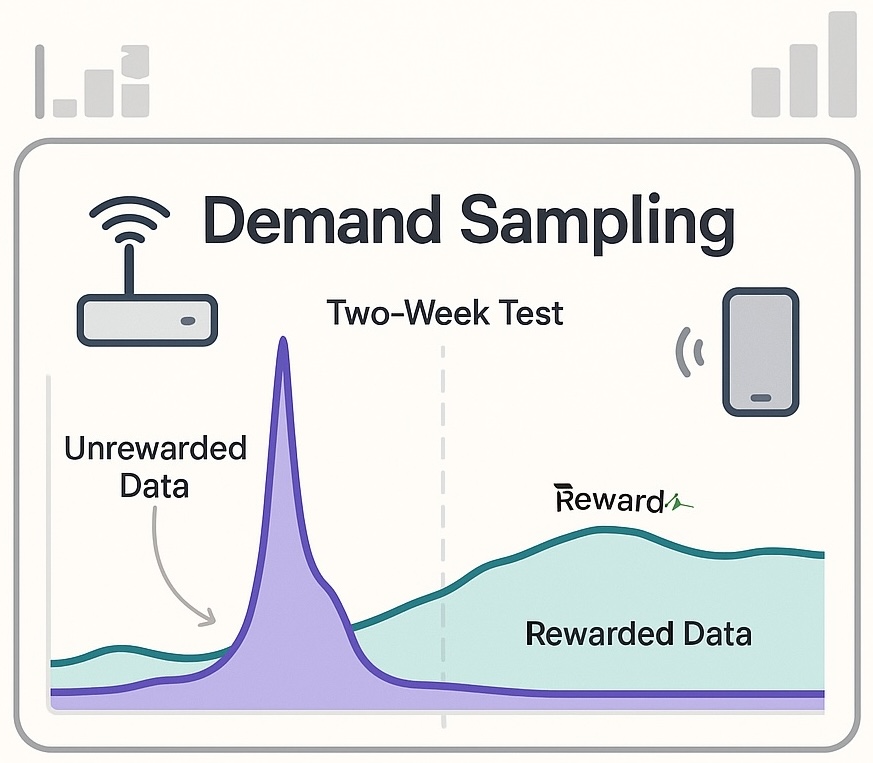

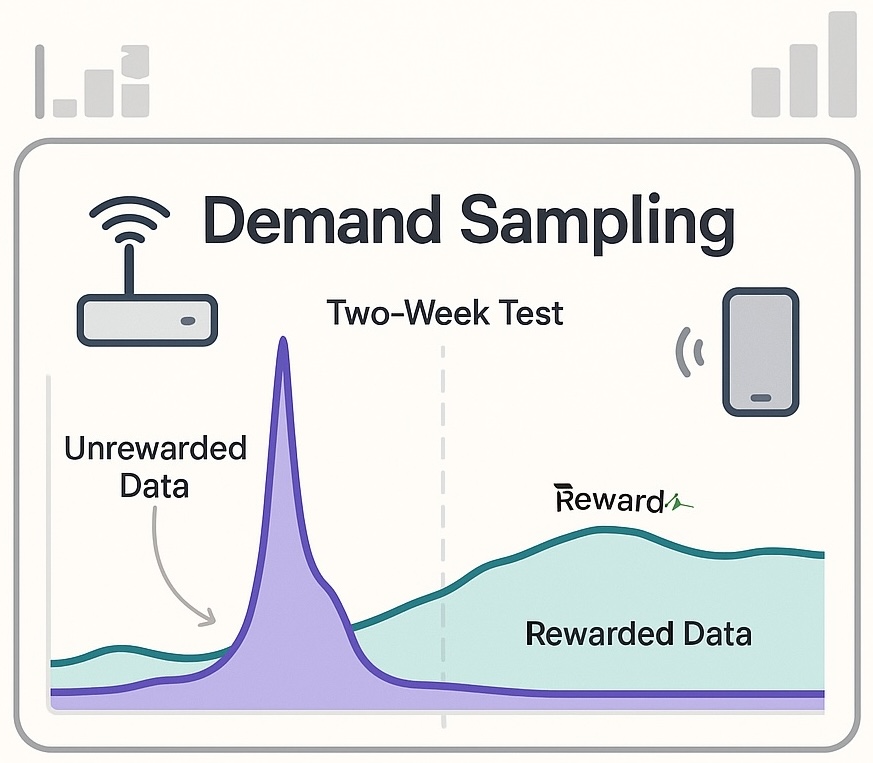

- If you onboard a new hotspot or assert a new location, that hotspot now handles real carrier traffic that shows up as “unrewarded” for about two weeks.

- This is expected and normal. That traffic is a demand signal carriers can combine with other data to decide if/when to enable rewarded carrier offload; sampling results alone do not guarantee or block selection.

- PoC rewards and existing offload setups are not being changed. The HIP-145 / new-PoC model is still just a proposal, not live.

- In HeliumGeek, Demand Sampling traffic already appears on hourly and daily charts with carrier-aware filters (details in the release notes).

If all you wanted to know is “why are my charts full of unrewarded data all of a sudden?”, that is the answer. The rest explains the change and what it means for hotspot operators and HeliumGeek users.

1. What Nova Actually Turned On

From Nova’s status update on status.helium.com and the announcement on X, in summary:

- The core team activated Demand Sampling for Helium Mobile hotspots.

- Newly asserted hotspots (including new onboardings and location changes) can handle unrewarded carrier traffic for about two weeks.

- The goal is to measure real demand at that location so carriers have better input when deciding whether to enable or expand rewarded offload.

- Hotspots with active MNO carrier offload are not affected for that carrier.

- The feature was enabled via configuration change only; no user action is required.

- Helium Plus deployments are not affected.

Translated to plain language:

- When you onboard a hotspot or assert a new location, that hotspot enters a two-week audition period.

- During those two weeks:

- Some carrier traffic is routed through your hotspot.

- In dashboards, that traffic appears as unrewarded data.

- You do not earn data rewards for those bytes.

- Metrics from this period become one of several inputs carriers may use when deciding whether your hotspot’s location has enough real subscriber demand to justify rewarded carrier offload.

That is all that is live today. There is no connection-attempt rejection logic in production and no new PoC formula based on Demand Sampling yet—just a two-week unrewarded-traffic window for new or newly moved hotspots.

2. Why You Suddenly See “Tons of Unrewarded Data”

If you just onboarded a mobile hotspot or recently reasserted the location of an existing hotspot to a new hex, you will likely see a spike of unrewarded data starting December 9 (and whenever you assert again afterward).

That behavior matches Nova’s description on Helium Status:

- Newly asserted hotspots sample carrier traffic for roughly two weeks after onboarding or a location assertion.

- Carrier traffic used for this sampling period is intentionally unrewarded.

This is what has been confusing people: dashboards show real traffic (often for AT&T or another carrier) but rewards show 0, and there was no obvious in-app messaging about the change. Community discussion (for example, this Reddit thread) echoes the same questions.

Your hotspot is not broken, and you are not being shadow-penalized. You are simply in the Demand Sampling window. After the two-week sampling period:

- If carriers see strong sampled demand (alongside other signals), your hotspot is more likely to be considered for rewarded offload for that carrier—but it is not guaranteed.

- Normal rewarded data behavior resumes; Demand Sampling for that carrier on that location is done.

3. What This Means for You as a Hotspot Operator

3.1. If you just deployed or moved a hotspot

During the first two weeks after assertion:

- You will see carrier traffic (often labeled with the carrier) that is flagged as unrewarded.

- You still earn PoC based on existing rules; this rollout does not modify PoC emissions or modeling.

The network is test-driving your new location before turning on the meter.

This is actually positive for serious deployers:

- Carriers and Nova can make enablement decisions faster because they have real, measured demand instead of only model-based guesses.

- You get an early, honest signal: if your location never sees much demand during sampling, you know you may need a better venue or installation.

Yes, it means two weeks of some “free” traffic to the network. The payoff, if your location is good, is earlier and more reliable rewarded offload.

3.2. If your hotspot already has rewarded offload

- Your current rewarded offload traffic for that carrier stays as-is.

- Demand Sampling may still be used for other carriers you are not yet offloading or if you move the hotspot and assert again.

If you are seeing mostly unrewarded traffic on a long-stable hotspot, that is likely another carrier in its own sampling period, or simply unrewarded traffic from the usual Allow Unrewarded Data setting (different feature).

4. How This Shows Up in HeliumGeek

HeliumGeek added Demand Sampling visibility and continues to surface those metrics (documented in the App Store release notes):

“Demand Sampling visibility: see demand-sampling traffic on hourly gateway charts and daily data screens, with carrier-aware filters.”

4.1. Where to look (Mobile App)

- In the HeliumGeek mobile app, open a Mobile Hotspot detail view.

- Go to hourly gateway charts to see:

- Normal rewarded data series.

- Additional Demand Sampling / unrewarded traffic series.

- Check the daily data screens for total sampled traffic per day.

- Use the carrier filters (AT&T or others) to see which carrier’s traffic is being sampled.

A concise in-app hint is planned for an upcoming release to note when a hotspot is in a Demand Sampling window and that some carrier traffic may be temporarily unrewarded while demand is measured.

4.2. Fleet-level view (Fleet Management)

- In the fleet platform, open the side menu and select Demand Sampling to see hotspots currently in sampling.

- Review sampled traffic and carriers for those hotspots to spot strong locations vs. weak ones.

- Use the view to decide which sites merit upgrades or moves based on early demand signals.

Demand Sampling metrics give fleet operators a quick read on where the network is routing trial traffic and which locations show meaningful demand.

5. What About HIP-145 and PoC Changes?

The HIP-145 “Demand Sampling” proposal describes a larger vision, including connection-attempt sampling and using Demand Sampling metrics directly for PoC. Today:

- HIP-145 is still a proposal, not a deployed economic change.

- The network is not doing “connection-attempt denial” in production.

- The network has not activated a new PoC formula based on Demand Sampling.

HIP-145 is still future-facing; today the only implemented piece is the two-week unrewarded traffic audition after onboarding or a location assertion.

6. Quick FAQ

Q: My hotspot shows a lot of AT&T traffic but rewards are zero. Is something wrong?

A: Probably not. If you recently onboarded or asserted a new location, you are in the two-week Demand Sampling window. That carrier traffic is intentionally unrewarded while Nova measures demand (Helium Status). After that period, the metrics are one input carriers can use—alongside other signals—when deciding whether to enable rewarded offload at that location.

Q: Did my PoC rewards change because of Demand Sampling?

A: No. This rollout does not change PoC. HIP-145 proposes a PoC model based on Demand Sampling, but that HIP is still a proposal and has not been activated.

Q: Is Helium just using my Wi-Fi for free now?

A: During the Demand Sampling window, some carrier traffic is indeed unrewarded. In exchange, carriers get better data to decide whether your hotspot’s location qualifies for ongoing, rewarded carrier offload.

Q: Does HeliumGeek show me when I am in a Demand Sampling window?

A: Yes. We surface Demand Sampling traffic on hourly and daily charts with carrier-aware filters, so you can clearly see which part of your traffic is sampled and unrewarded. You can also filter by carrier and compare hotspots in your fleet to see where demand is strong during audition periods.